#1 Guide To A Successful Salesforce QuickBooks Integration

Integrating QuickBooks with Salesforce can revolutionize your business operations by combining financial data with CRM capabilities to create a seamless and efficient workflow. This powerful integration not only streamlines processes but also reduces errors and provides real-time insights, enhancing your decision-making capabilities. To harness the full potential of both platforms, meticulous planning and execution are crucial. Ensuring data consistency, choosing the right tools, and aligning your integration with your business goals are key to a successful Salesforce QuickBooks Integration. This comprehensive guide will walk you through the essential steps to optimize your integration and maximize the benefits of this robust combination.

Preparing for your Salesforce QuickBooks Integration

QuickBooks extends beyond invoicing; it includes a diverse range of features such as tracking bills, creating purchase orders, generating estimates, and producing sales receipts. With numerous Salesforce QuickBooks integrations on the market, each offering different functionalities, it is crucial to carefully evaluate each option before making a decision. This guide will help you navigate the necessary steps to prepare for your Salesforce QuickBooks Integration, ensuring you select the optimal solution tailored to your business needs.

QuickBooks and Salesforce Sync and Mapping Settings

Effective sync and mapping settings are pivotal for ensuring a smooth and accurate integration between QuickBooks and Salesforce. These settings dictate how data is transferred and mapped between the two systems, significantly impacting your operational efficiency. Here’s a detailed overview of key areas to focus on:

1. Syncing QuickBooks Customers with Salesforce Accounts.

A fundamental step in your Salesforce QuickBooks Integration is understanding how QuickBooks customers are mapped to Salesforce accounts. Different integrations employ varying mapping methods. Some use reference IDs at the account level, while others create customers as separate records. Reference ID mapping may limit functionality, such as invoicing child QuickBooks customers under a parent account. Conversely, generating customers as records offers greater flexibility, enabling you to map multiple QuickBooks customers to a single Salesforce account, thus optimizing your workflow.

Additionally, integrations may import customer data with different levels of detail. For instance, one integration might sync basic information like first name, last name, company, and email, while another could provide comprehensive data syncing, including notes, billing with parent, print on check name, and additional fields. Understanding these distinctions is essential for selecting the right integration. Discover how Tally’s Salesforce QuickBooks Integration handles customer imports and account mapping to enhance your CRM and accounting efficiency. Learn more about Tally’s advanced features and how they can streamline your financial processes here.

2. Synching and Mapping your QuickBooks and Salesforce Products.

Mapping products between QuickBooks and Salesforce may seem simple, but it involves complexities that can affect your business operations. Many integrations offer only one-way syncs, typically from QuickBooks to Salesforce, syncing basic product details such as name, description, and sale price. However, other integrations provide additional features, including SKU, inventory quantity, and class tracking.

To ensure your product sync aligns with your workflow, determine how you wish to utilize the product data and verify whether your solution provider supports these requirements. Some integrations offer a two-way sync, allowing you to update product type, description, inventory quantity, SKU, assigned QuickBooks class, sale price, and more across both systems. Choosing the right integration can significantly enhance your product management and overall operational efficiency. Evaluate your options carefully to find the integration that best suits your business needs.

3. Syncing QuickBooks Classes with Salesforce.

Class tracking in QuickBooks is a powerful feature that categorizes income and expenses, providing detailed insights into profitability across departments, projects, or custom-defined categories. This capability is essential for making informed financial decisions by offering a clear view of your financial landscape. In Salesforce, QuickBooks Classes can be tracked per line item when generating invoices, estimates, sales receipts, and more.

Verify with your solution provider whether they support class tracking, as some integrations may not include this feature. Class tracking can be utilized at the invoice level or line item level, with the QuickBooks API supporting only the line item level. If your integration provider offers class tracking, it will be at this level. Ensuring that your integration meets your class tracking needs is crucial for optimizing your financial management processes.

4. Syncing QuickBooks custom fields with Salesforce.

In QuickBooks, you have the flexibility to create custom fields for various documents, including invoices, sales receipts, refund receipts, estimates, credit memos, and purchase orders. This feature allows you to add customized data and generate detailed reports. Many Salesforce QuickBooks Integrations offer custom field functionality, but be cautious with wording as some integrations may have limitations in flexibility. For example, some integrations may not support the population of custom fields when automating QuickBooks invoices in Salesforce. Ensure your chosen integration can handle custom fields effectively to meet your specific business needs.

4. Syncing QuickBooks Vendors fields with Salesforce.

If you’re looking to generate QuickBooks Purchase Orders directly within Salesforce, it’s crucial to have your vendors synced between the two platforms. This synchronization ensures that you can smoothly create accurate and timely purchase orders without manual data entry. The same requirement holds true for generating bills in Salesforce. Without synced vendors, you won’t be able to leverage the full capabilities of QuickBooks and Salesforce integration, which could lead to inefficiencies and potential errors in your financial management processes.

However, it’s important to note that not all integrations between QuickBooks and Salesforce support the creation of bills or purchase orders. In such cases, the need for syncing vendors within Salesforce becomes irrelevant, as these features are simply not available. This can be a deciding factor when choosing an integration solution, especially if your business relies heavily on efficient vendor management and the ability to generate purchase orders and bills directly from Salesforce.

By ensuring that your integration supports these critical financial operations, and by keeping your vendor data synchronized, you can take full advantage of the seamless workflow between QuickBooks and Salesforce, ultimately improving your business efficiency and reducing the risk of errors.

5. Syncing QuickBooks Chart of Accounts with Salesforce.

The chart of accounts is a comprehensive list of all the accounts QuickBooks uses to track your financial data. Each account monitors your transactions and displays your balances, helping you categorize transactions effectively and set up the chart of accounts accurately to ensure your books are precise. There are three key reasons why you may need to sync your QuickBooks chart of accounts with Salesforce: to generate purchase orders, to process refunds, and to gain a complete view of all your financial data directly within Salesforce.

6. Syncing QuickBooks Custom Tax Rates with Salesforce.

7. Syncing QuickBooks Payment Methods with Salesforce.

The QuickBooks payment methods object stores the payment methods you use for accounts receivable tasks. For instance, if you receive a check and want to mark an invoice as paid in Salesforce while syncing that information to QuickBooks, syncing payment methods is essential to select ‘Check’ as the payment method. As of August2024, Tally is the only QuickBooks and Salesforce integration that supports refund receipts, making us the only solution that syncs payment methods seamlessly.Salesforce QuickBooks Integration

Salesforce QuickBooks Integration: Key Considerations for Invoices, Estimates, Sales Receipts, Refunds, Bills, Purchase Orders, and Time Tracking.

Now that we’ve covered sync settings, let’s explore what to look out for when integrating QuickBooks with Salesforce. This section will dive into the critical aspects of integrating QuickBooks invoices, estimates, sales receipts, refunds, bills, purchase orders, and time tracking. Understanding these elements is essential for optimizing your integration and ensuring seamless financial management across both platforms.

1. Invoicing

Among the most sought-after features in QuickBooks and Salesforce integrations, invoicing stands out as a top priority. While most integrations offer invoicing capabilities, some may lack essential functionality. Here’s what you need to consider:

User Experience for Invoice Creation: Ensure the integration provides a user-friendly experience that allows you to create invoices directly within Salesforce. Some solutions offer automated invoicing that only functions at the opportunity level, which may not meet your needs.

Invoicing from Specific Objects: Verify whether you can invoice from custom objects or the specific object you intend to use. Not all integrations support this flexibility, which can limit your ability to manage invoices effectively.

Bidirectional Syncing: Check if the integration supports bidirectional syncing. While some solutions only sync information from Salesforce to QuickBooks, others might only update invoice statuses in Salesforce. It’s crucial to ensure that products, address information, and other related fields are updated in Salesforce when changes occur in QuickBooks.

PDF Download and Invoice Management: Confirm that you can download invoices as PDFs from Salesforce and void invoices as needed. This feature is essential for efficient document management and record-keeping.

Advanced Payment Processing: If you need to process credit card payments, receive payments, or edit and resend invoices from Salesforce, note that as of now, Tally is the only solution that offers these functionalities.

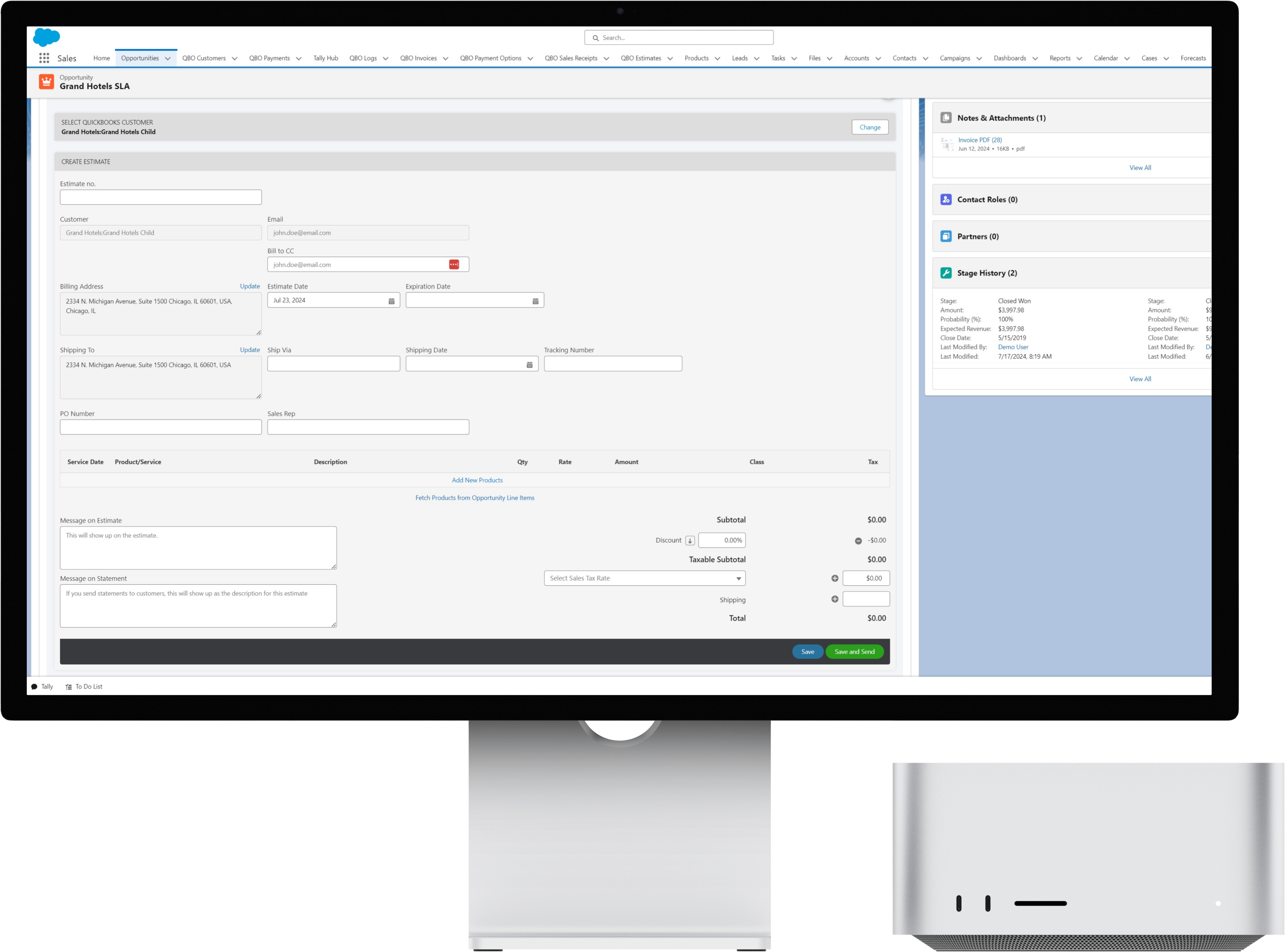

2. Estimates.

QuickBooks estimates work similarly to invoices, but are used for approval rather than payment. When integrating Salesforce with QuickBooks for estimates, prioritize ease of use. Verify if you can generate an estimate by converting an invoice instead of manually entering details. Ensure your Salesforce QuickBooks integration provider supports updating the estimate status in Salesforce and reflecting it in QuickBooks. Also, confirm that you can add the date of acceptance or rejection and the responsible person. This article from Fourlane explains how to fully harness the power of QuickBooks Estimates.

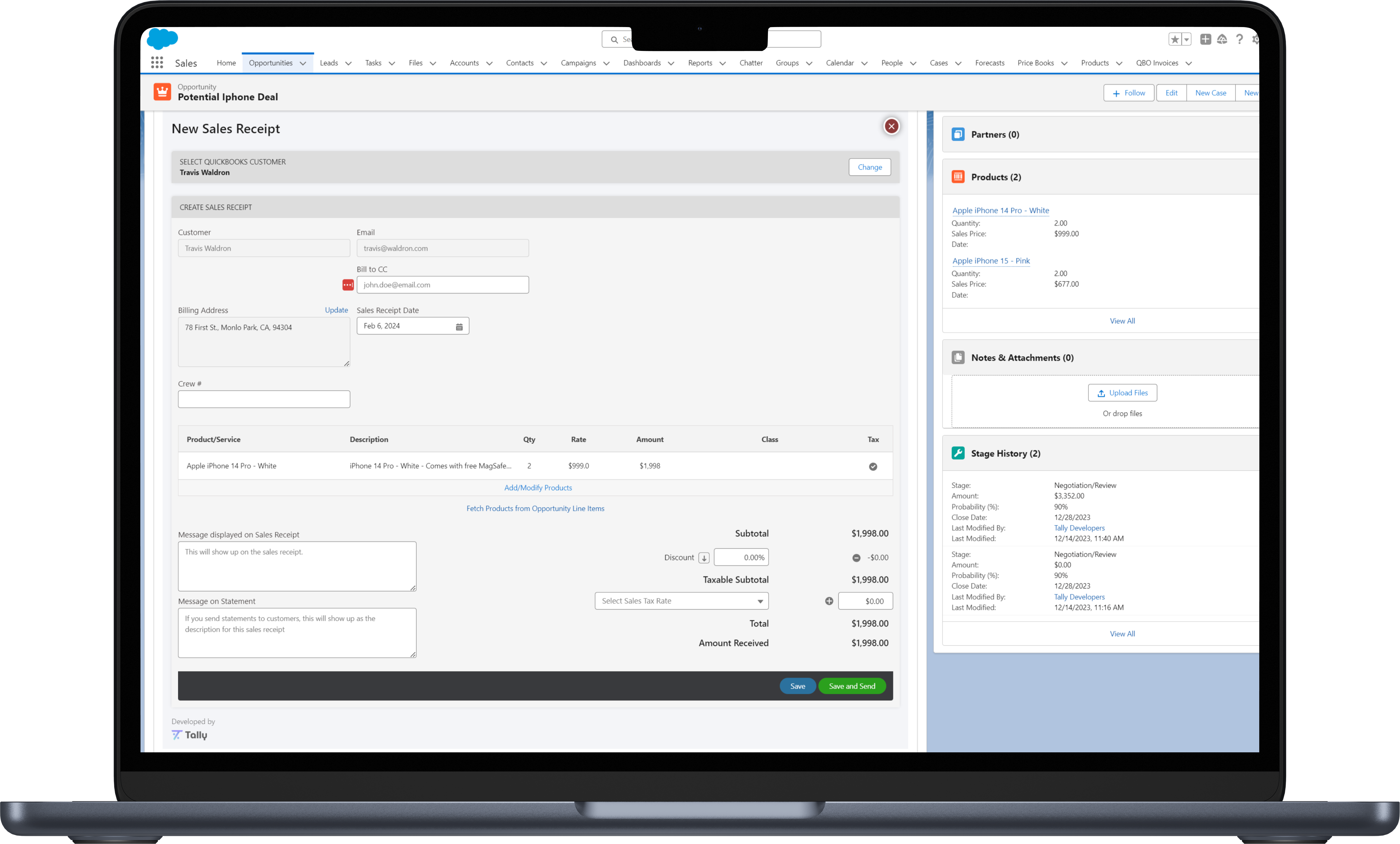

3. Sales Receipts.

In QuickBooks, sales receipts are used to record immediate payments from customers. When integrating Salesforce with QuickBooks for sales receipts, focus on seamless functionality. Ensure you can create and manage sales receipts directly from Salesforce, avoiding manual data entry. Check that your Salesforce QuickBooks integration provider supports real-time syncing of sales receipt data and updates the status accurately in both systems. Additionally, verify that you can track payment details and update receipt information efficiently within Salesforce.

4. Refund Receipts.

Refund receipts in QuickBooks are crucial for processing customer refunds efficiently. For a successful Salesforce QuickBooks integration, ensure you can create and manage refund receipts directly within Salesforce, eliminating manual data entry. Verify that your integration solution supports real-time syncing of refund receipt data and updates statuses accurately across both systems. Additionally, ensure that payment methods are synchronized to accurately identify the account from which refunds are issued and manage refund details effectively in Salesforce.

4. Purchase Orders.

QuickBooks purchase orders don’t require QuickBooks customers, allowing you to generate purchase orders from any Salesforce object. While some Salesforce QuickBooks integrations include the purchase order feature, functionality can vary. Ensure your integration provider synchronizes essential elements such as your chart of accounts, vendors, customers, classes, and products to deliver a complete purchase order experience.